I’m not one for waving a political flag on my blog too often, but this is very important. With tax reform under the microscope on capital hill, one very important piece of legislation is coming to the chopping block – The Orphan Drug Act.

From Investopedia: “[The Orphan Drug Credit is] A federal tax credit that provides an incentive for pharmaceutical companies to seek treatments and cures for rare diseases affecting Americans…The Orphan Drug Credit provides a credit of 50% of clinical drug testing costs for drugs being tested under section 505(i) of the Federal Food, Drug and Cosmetic Act…The credit can be applied whether the clinical tests are performed directly by the pharmaceutical company or are contracted out to a third party. In general, the testing must be conducted within the United States.”

Basically this federal tax credit creates an incentive for pharmaceutical companies to pursue drug development for rare disease by using half of the costs of clinical trials to reduce their tax liability (as well as a few other reasons, but I want to focus on this part of it). Drug development in the rare disease sector (of which cystic fibrosis is a part of) is an incredibly risky business model simply because of the number of patients and the amount it costs to push a drug through clinical trials.

Developing a drug then sending it through clinical trials towards FDA approval is a costly process. According to a report prepared in part by the National Organization of Rare Disorders, it can cost in the neighborhood of $2.6 billion to bring a drug to market. The cost of failures in R&D is a significant part of the cost. In the world of rare disease world this is incredibly significant because of the number of patients who then receive an approved drug is much smaller than non-orphan drugs, which means that we, rare disease patients, proportionately feel the $2.6bn cost of drug development. For example, millions of people use insulin, while a relatively small number of people use Pulmozyme. According to the report:

After a drug receives market approval, the developer can begin to recover its investment in the discovery and research process. For orphan drugs, the opportunity is diminished due to the limited pool of potential patients, which is one reason many drug developers find it difficult to justify the investment required to develop treatments for rare diseases. According to the ODA (Orphan Drug Act [the tax credit]), orphan drugs are designed to treat conditions that exist in less than 200,000 patients in the United States, and for many rare diseases, the number of cases may be far less than 200,000 [CF impacts only about 30,000-40,000 people in the US].

Spreading the cost of developing a new drug over small patient populations could result in a per-patient cost of tens of thousands of dollars. As a result, prior to the ODA, many promising discoveries never received the investments required to turn them into viable orphan drugs.

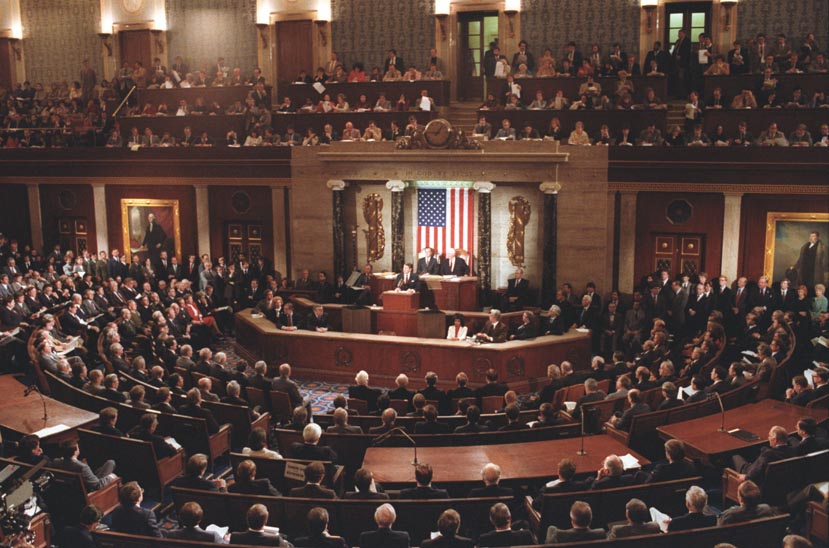

So what’s happening in Washington?

Tax reform is charging through the legislative branch. I don’t really care how you feel about tax reform as a whole; I really just care about this.

Last week the House voted to repeal this credit as a way to help pay for tax reform. The Senate version of the bill keeps the ODA in place, but reduces the tax credit from 50% to 27.5%.

According to an article on The Hill, the House Republicans justify this move by saying, “The bill preserves the R&D credit and lowers the corporate tax rate from 35 percent to 20 percent — so pharmaceutical manufacturers can invest more of what they earn in new solutions for patients.”

But in the Senate, as the article also notes, Senator Orin Hatch (R-Utah), “was one of the primary sponsors of the (ODA) in 1983, ” which is probably a reason why the Senate continues to back the tax credit.

The article in the Hill also says that some on the left don’t love the ODA because they think that some drug companies abuse the law for financial gain.

Ultimately the ODA is a great thing if you a cystic fibrosis patient because we are some of the rarest of the rare when it comes to chronic illness. Without it in place, I fear that drug development may stagnate, as the pharmaceuticals will need even more capital to develop new orphan medications. Capital comes from investment, drug prices, reimbursement, etc.

I think the report mentioned above does a pretty good job of explaining why it’s incredibly important for both patients and developers. An average cost of $2.6bn for a new drug to hit the market is an enormous burden that is felt by patients.

For reference, the Cystic Fibrosis Foundation reported total assets at $3,931,907,061 in 2016. They alone cannot finance a drug to market and then continue their mission.

The tax credit helps alleviate the financial burden, at least partly.

The incentive MUST remain for pharmaceuticals to continue pushing drug development for rare disease. I urge you not to be blinded by your larger political outlook and learn more about the ODA. I have long said that we can continue as is with our current treatments and hope for the best, or we can help push research and development until we have positive clinical outcomes for all cystic fibrosis patients.

The pharmaceuticals need our help here so they can continue to produce life saving medications.